Subscribe for all my updates and don't miss a thing! Sign me up!

what are the features of the Jamaican P.A.Y.E system?

by Paul Gayle

(Kingston, Jamaica)

what are the features of the Jamaican P.A.Y.E system?

-Paul

ANSWER: by Wellesley Gayle

Hi Paul,

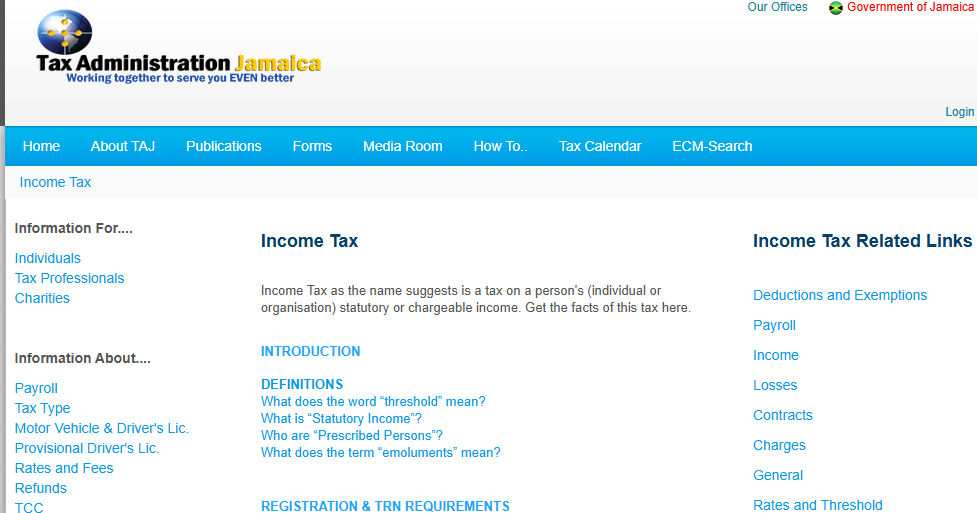

So the P.A.Y.E. system in Jamaica, which stands for Pay As You Earn , is the method the Jamaican government uses to collect income tax from people who are employed. It’s mainly handled through your employer, who takes out the required taxes before you get your salary in your hand or bank account.

But let’s walk through the main features:

- Employer Withholding`

Under the P.A.Y.E. system, your employer is responsible for:- Calculating the tax based on your earnings.

- Deducting the correct amount each pay period.

- Paying it over to the Tax Office (TAJ) on your behalf - that way you don’t have to run up and down at the end of the year, it’s handled as you go.

- Calculating the tax based on your earnings.

- Personal Income Tax Threshold

Every Jamaican resident is entitled to a tax-free income threshold.

As at March 2025 (but will be increased soon)- The income tax threshold (aka “tax-free allowance”) is $1.5 million JMD per year.

- That means you only pay income tax on income above that amount.

For example:

If you earn $2 million per year, you’ll only be taxed on the $500,000 above the threshold.

- The income tax threshold (aka “tax-free allowance”) is $1.5 million JMD per year.

- Tax Rates

The standard income tax rates under the PAYE system are:- 25% on annual income above $1.5 million and up to $6 million.

- 30% on the portion that exceeds $6 million annually.

That means that higher earners pay more on the portion above $6M, that’s called marginal tax rate.

- 25% on annual income above $1.5 million and up to $6 million.

- Statutory Deductions (Along with PAYE)

When you get your pay slip, you’ll usually notice other deductions alongside PAYE, such as:- NIS (National Insurance Scheme) – this should help with pension and other benefits

- NHT (National Housing Trust) – helps you qualify for housing benefits.

- Education Tax – supports Jamaica’s education system and

All of these are calculated and submitted by your employer along with the income tax.

There's another one you won't see but is paid by your employer on your behalf - HEART – It goes toward the HEART Trust vocational training programs.

- NIS (National Insurance Scheme) – this should help with pension and other benefits

- Monthly Filing & Remittance by Employer

Employers must:- Deduct PAYE and statutory contributions every month.

- File a monthly S01 form with TAJ showing details of salaries and deductions.

- Submit payments by the 14th of the following month.

- Deduct PAYE and statutory contributions every month.

- Annual P24 & P45 Forms

At the end of the tax year, employees should receive a P24 form showing total earnings and deductions for the year.

If you leave a job, you should get a P45, which you can pass to your next employer. These forms are useful if you’re doing any tax returns or need proof of income.

The beauty of PAYE is that you don’t usually need to file a tax return unless you have other sources of income (like rental, freelance, or overseas earnings) - it’s all handled automatically, hence the name "Pay As You Earn".

For persons who are self-employed or have other income sources, they'll fall under a different tax structure.

I hope this helps.

Thanks again for a great question.

Regards,

WG

P.S. Do you have a question as well? Submit it to us here! With We've answered well over 2,600 questions answered, so chances are we can help you :-)

New! Get My Latest Book👇🏿

|

You asked, I've answered! You no longer need to save for months or years, to enjoy paradise! I spilled the beans! sharing my top tips on finding cozy accommodations and secret gems, only the way a native could! Click Here to pick it up on my e-store and start saving now! |

See The Best Of Jamaica - In Videos!

|

My channel reaches over 140,000 subscribers worldwide and has leveraged over 11 million views, sharing, what I call 'The Real Jamaica'. Subscribe today and join our family of viewers. |

Read More ...

New! Experience The REAL Jamaica!

Book Your Private Tour here and experience Jamaica the way we (locals) do!

P.S. Didn't find what you were looking for?

Still need help?

Click Here to try our dependable and effective Site Search tool. It works!

Or, simply click here and here, to browse my library of over 500 questions and answers! Chances are someone already asked (and got an answer to) your question.