Subscribe for all my updates and don't miss a thing! Sign me up!

What are statutory deductions in Jamaica?

(Click to Zoom)

Contributed

What are the statutory deductions in Jamaica?

Great! Thanks for asking!

Please get familiar with... let's call him John.

He is an accountant at XYZ Company Limited.

On a monthly basis John earns $130,000 JMD.

We'll now use him to demonstrate the concept of statutory deductions, ok.

Ready.

What is the meaning of statutory deduction?

So yes, John receives a gross salary of $130,000 JMD per month.

However after statutory deductions he takes home his net pay of $121,179.50 (*accurate at 2018 rates - see above).

From this scenario you can guess a little what statutory deductions are? Right?

If you guessed that it's an amount taken out of ones salary, or contributions taken for a specific purpose, then you are on the right path.

To be exact, statutory deductions are amounts subtracted (taken) from employed persons' salaries for the government, in percentage or fixed, through employers.

The rates are usually small and involuntary, and yes, because they are taxes, you don’t have a choice, you MUST pay them.

This is unlike voluntary deductions (the opposite) which is paid out of ones salary voluntarily, like giving to a charity or as a standing order to a personal bank account.

So after John's statutory deductions are paid, if he had contributed a small amount to a charity for animals per se, or an amount to credit union, it would have been a voluntary deduction and deducted every month- unless he asks for it to be discontinued.

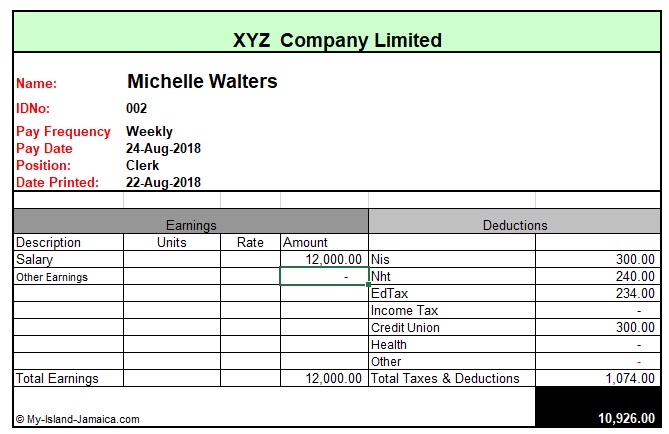

In this case however he didn't, see Michelle's paystub below.

Who pays statutory deductions and what type of persons are exempted?

Once someone is working and is 18 years or older they must pay statutory deductions. To be exact, taxes are paid by everyone who is earning a salary are emoluments.

Therefore this would include:

- Regular full-time workers

- Part time workers

- Holiday workers

- Casual workers

- People on contract for services

- Persons who receive pension

- Fixed term contract workers

- Student workers who work within the holiday period will have to pay 25% statutory deduction(tax) on their salaries. However student workers who work outside of the holiday (June to August) will not pay any statutory deductions.

Who Are Exempted

- Persons who are disabled, whether mental or physical - these persons have to be registered with the relevant councils like the Jamaica Council for the Handicapped

- Emigrants from the US and UK(24 months)

- Some pensioners will receive an additional exempt amount which is added to the statutory deduction threshold which is not taxed.

- Pensioners receives an additional exempt amount which is added to the tax threshold which is not

taxed.

What are the basic statutory deductions in Jamaica?

If you are employed, these are the ones you need to know about first.

- NIS (National Insurance Scheme)- usually 2.5% of Total Gross Earnings- So taxes paid goes into a fund which contributions benefit the individual after retirement.

- NHT( National Housing Trust ) - usually 2% of Gross Earning. Taxes paid goes into a pool which contributors can benefit from for loans for purchase of a home improvement at relatively low interest rates.

- PAYE/INCOME TAX - usually 25% of Taxable Earning (Gross Pay- Calculated NIS - exempt amount). This is usually the bigger of all employee taxes which goes to the government. This they say is used for social work or to pay those who takes care of us - policemen, nurses, teachers etc.

- EDUCATION TAX - 2% of gross emoluments after NIS. This, they say, is used to assist with expenditure relating to educational development and infrastructure.

Below is another example, showing calculation for a weekly paid employee in Jamaica at 2018 tax rates. I hope this helps. Again, thanks for asking.

For additional information on payroll/ statutory deductions in Jamaica, including employer responsibilities, visit the Tax Administrations' website here.

(Click To Zoom)

(Click To Zoom)P.S. Remember to click here get even more answers to frequently asked questions about Jamaica.

New! Get My Latest Book👇🏿

|

You asked, I've answered! You no longer need to save for months or years, to enjoy paradise! I spilled the beans! sharing my top tips on finding cozy accommodations and secret gems, only the way a native could! Click Here to pick it up on my e-store and start saving now! |

See The Best Of Jamaica - In Videos!

|

My channel reaches over 140,000 subscribers worldwide and has leveraged over 11 million views, sharing, what I call 'The Real Jamaica'. Subscribe today and join our family of viewers. |

Read More ...

New! Experience The REAL Jamaica!

Book Your Private Tour here and experience Jamaica the way we (locals) do!

P.S. Didn't find what you were looking for?

Still need help?

Click Here to try our dependable and effective Site Search tool. It works!

Or, simply click here and here, to browse my library of over 500 questions and answers! Chances are someone already asked (and got an answer to) your question.