Subscribe for all my updates and don't miss a thing! Sign me up!

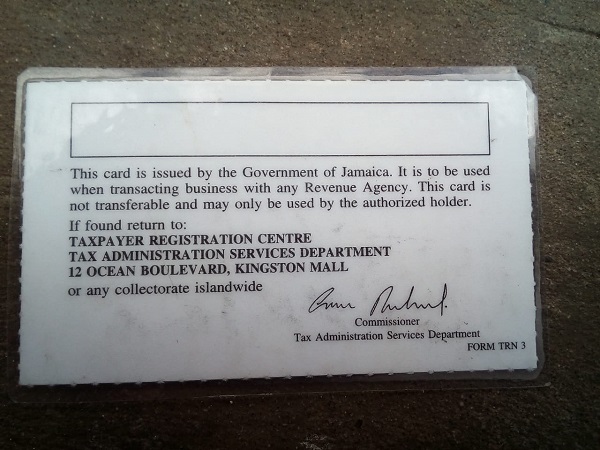

The TRN Number

What Is It? Why The Need? And How Do I Apply?

Sharing Is Caring! Share this awesome content with your friends now.

If you’re planning to do any sort of business here in Jamaica, including applying for a loan, obtaining a driver’s license and applying for a job, you'll be asked to show or bring along your TRN number.

Now, the abbreviation TRN stands for Tax Registration Number - so yes, technically we should only say TRN, not TRN number😊

New! Take a piece of Jamaica with you💃!

Savour the memories! Now you can get your authentic Jamaican souvenir items, as well as traditional Jamaican herbs, spices and housewares on our popular e-store. Click Here to learn more.

And, if you ever need a trustworthy and knowledgeable local guide, consider booking a private tour with us!

Anyways, according to the Tax Administration of Jamaica (TAJ), the TRN is a unique nine-digit number assigned to each individual taxpayer, business enterprise or organization by way of an automated system here in Jamaica.

In the past, several numbers were given to one individual by the various Tax Department. But since November 2001, The TRN has replaced all the other numbers and has been used, through the Tax Administration Reform Project, to regulate and integrate the information system in the Tax Departments.

Other Examples Of Times You'll Need A TRN Number?

Here are some occasions when you’ll definitely need your TRN number if you’re doing business with the revenue department:

- Filing Tax Returns

- Paying GCT & SCT

- Paying statutory deductions - Income Tax, Education Tax, NIS and NHT contributions

- Obtaining a road licence

- Paying Income Tax & Company Tax on profits

- Obtaining a driver’s licence

- Obtaining a licence for various business activities

- Application for titles of motor vehicles

- Paying Customs duties

- Paying Withholding Taxes

- Etc.

How Can I Obtain A TRN Number?

Individuals

- Over the Age Of Eighteen Years

For individuals over the age of eighteen, you’ll be required to bring in the following documents:

>Completed Application Form

> Suitable Identification - Passport, National Identification Card or Driver’s Licence

> A certified copy of your Birth Certificate - Under the Age Of Eighteen Years

However, if you’re applying for someone below the age of 18, the application form must be completed and signed and/or co-signed by the parent or guardian. - Minors

If you are the minors parent, you will have to submit the following documents:

> Certified copy of the child’s birth certificate.

Please note, the parent who signed the application form name must be shown on the Birth Certificate

> Certified photograph or picture identification for child.

> Suitable Identification and TRN of the parent

On the other hand, if you’re the minor’s guardian, you will need to submit the following:

> Certified copy of the child’s birth certificate.

> Certified photograph or picture identification for child.

> Identification & TRN of the guardian.

> Court Order or Voluntary Declaration for guardian OR

Voluntary Declaration from the guardian and Voluntary Declaration from an Attester.

An Attester is a person who knows of the Guardian/Child relationship. - Overseas Applicants

No problem, mon! Even if your overseas you can still apply for a TRN.

• Complete and sign an Application Form

TRN Application forms can be downloaded from the TAJ’s website at www.jamaicatax.gov.jm.

• Copy of applicant’s Passport OR Drivers Licence which must be notarized by a Notary Public.

The applicant’s full name (first, middle, last), date of birth, photograph and signature must be shown on the ID.

• If you want someone to collect the TRN card for you then an authorization letter from the applicant should be attached, stating the name of the person authorized to collect the card.

It should be noted, if the Identification or supporting documents are not in English, an official translated version is also required.

Also, the signature on the ID and application form must match. - A Disabled Person

If the applicant is disabled and you’re their caretaker they can attain a TRN. Here are the documents you’ll need:

• Suitable identification for the disable person.

• Identification & TRN of the Caretaker

• Power of Attorney OR Medical Certificate, Voluntary Declaration from the Caretaker AND Voluntary Declaration from an Attestor (A person who knows of the Caretaker/Incapacitated Adult relationship).

It should be noted that photographs must be certified by Justice of the Peace, Minister of Religion/ Marriage Officer, Judge/ Resident Magistrate, Attorney-at-Law, Member of Parliament, Parish Councillor, Medical Doctor, School Principal, Civil Servant (SEG3 or above) or Police officer at the rank of Inspector or above.

Along with the certified photograph, a Declaration from the Certifying Official must be attached.

This form can be collected at the local Tax Office or be printed from TAJ’s website www.jamaicatax.gov.jm

Companies/ Organizations

- Local Companies

To obtain a TRN for a Jamaican company the following documents are required:

• “Application for TRN-Organization Form 2” must be completed and signed by a director or the company secretary

• Certificate of Incorporation

• Verification of NIS registration (NIS Verification/Clearance Letter or Payment Card)

• TRN for each Director

• ID for Signatory Officer

• Companies registered before February 1, 2005 are required to submit an Articles and Memorandum of Association.

If the directors are not named in the Articles of Association, either the Form 12, Form 13 of Form 23 under the Companies Act is required.

• Companies registered as of February 1, 2005 are required to submit Articles of Incorporation. However, if the directors are not named in the Articles of Incorporation, Form 23 is required. - Foreign Companies

Yes, overseas companies will also need a TRN.

If the company has no established place of business in Jamaica, then the following is required:

• Completed Organization form signed by Director

• Registration and/or Charter Documents (issued in country of origin)

• ID for Signatory Officer

• Letter from company indicating that it is not operating nor has an established business place in Jamaica

Please note that only original or notarized copies of the Registration or Charter Documents are accepted.

Additionally, if the Identification or supporting documents are not in English, an official translated version is also required. - Foreign Companies - with local branches

If the company is operating or has established place of business in Jamaica, then the following documents should be submitted:

• The completed Organization form signed by a Director or the Local Representative

• Letter of Registration (issued by the Companies Office of Jamaica)

• Verification of NIS registration (NIS Verification/Clearance Letter or Payment Card)

• Form 19 or 31 (issued by Companies Office of Jamaica) stating Local Representative and Directors

• TRN for the Local Representative or at least one Director

• ID for Signatory Officer

Please note that a TRN is required for the Signatory Director or Local Representative. Other overseas directors are not required to provide a TRN number. - Partnerships

When Partnerships are obtaining their TRN the following must be submitted:

•The completed ‘Form 2’ signed by a partner must be submitted

• Business Name Registration Certificate (BNRC) if registered

• NIS Clearance Letter or Payment Card

• TRN and NIS of each partner

• ID of Signatory Officer - Schools

As I mentioned earlier to you, even schools are in need of a TRN.

Here is basically what needs to be submitted:

• The completed Organization form signed by Principal or Board Member

• Letter indicating registration/recognition from Ministry of Education or Early Childhood Commission.

• Verification of NIS registration

(NIS Verification/ Clearance Letter or Payment Card)

• TRN for each Responsible Officer

• ID for Signatory Officer - Industrial & Provident Societies

For the above, the following are what needs to be submitted:

• The completed Organization form, signed by a Responsible Officer must accompany the...

• Certificate of Registration (issued by the Companies Office of Jamaica)

• Verification of NIS registration (NIS Verification/Clearance Letter or Payment Card)

•.TRN for each Responsible Officer

• ID for Signatory Officer

That’s basically it, but I've broken it down based on the requirements for different categories of applicants.

What Happens After I Apply For My TRN Number?

You will be provided with a slip of paper with your TRN written on it. You can use the letter that you have received until you get your card.

Also, you should bear in mind that the TRN is not a form of identification.

Did You Know?

By the way, did you know that:

- No fees are involved in obtaining the TRN? And also that

- You can be penalized for not obtaining your TRN?

The law requires that every person carrying out transactions with a Tax Department be registered and obtain a number.

Under the law, it is an offence for persons not to register. The fines are currently:

Business: $5,000 or 1 month’s imprisonment

Individual: $1,000 or 1 month’s imprisonment

Well, there you go... to be warned is to be armed :-)

Are Any of these helpful?

- National ID Card (Voters ID)

- National Youth Service

- Charity in Jamaica - How Do I Go About Setting One Up?

- How to obtain a Police Record in Jamaica

- What do I need to register a business in Jamaica?

Sharing IS Caring! Please help me get the message out by sharing this article with your friends on social media (links below). Thnx ;-)

If you found this page useful, please consider subscribing to my weekly newsletter, to get even more.

It tells you each week about the new information that I have added, including new developments and great stories from lovers of Jamaica!

Return to How To Jamaica from Jamaican TRN Number

Return to My Island Jamaica Homepage from Jamaican TRN Number

References & Sources For Jamaican TRN Number

- How to Apply For your TRN, Tax Administration Jamaica, https://www.jamaicatax.gov.jm

Updated: August 1st, 2022

New! Get My Latest Book👇🏿

|

You asked, I've answered! You no longer need to save for months or years, to enjoy paradise! I spilled the beans! sharing my top tips on finding cozy accommodations and secret gems, only the way a native could! Click Here to pick it up on my e-store and start saving now! |

See The Best Of Jamaica - In Videos!

|

My channel reaches over 140,000 subscribers worldwide and has leveraged over 11 million views, sharing, what I call 'The Real Jamaica'. Subscribe today and join our family of viewers. |

Read More ...

New! Experience The REAL Jamaica!

Book Your Private Tour here and experience Jamaica the way we (locals) do!

P.S. Didn't find what you were looking for?

Still need help?

Click Here to try our dependable and effective Site Search tool. It works!

Or, simply click here and here, to browse my library of over 500 questions and answers! Chances are someone already asked (and got an answer to) your question.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.