Subscribe for all my updates and don't miss a thing! Sign me up!

Jamaicans And Retirement Savings Plan (Pension Plan) – 10 Surprising Facts

by Deon Clarke | Associate Writer

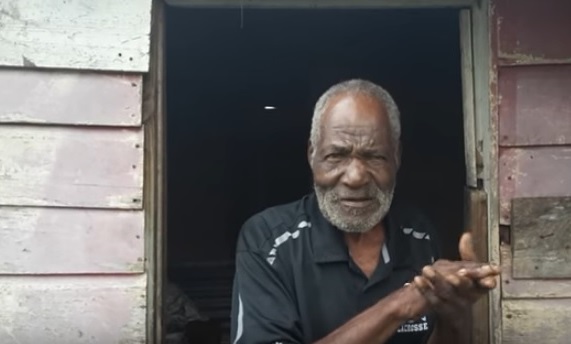

Photo: Mr. Kenneth Brewster

Have you ever wondered why so many Jamaicans do not have any form of retirement savings? Let’s face it, retirement is a grim reminder of our own mortality which is hard for many to accept. So, in light of this many choose to use delay tactics of the inevitable. With that said, let’s take a look at 10 surprising facts about how Jamaicans view retirement savings or plans which contributes to why many Jamaicans do not have a pension or retirement savings plan in place.

- Most Jamaicans Are Too Busy To Consider It

Many Jamaicans are so absorbed into their everyday lives and jobs that they are just too busy to even think about retirement. They really would want to develop a good retirement plan but simply cannot find the time or make the time to do so. It’s just not a goal right now and they convince themselves that they have time. “I’ll do it next week, or next month or next year”, and before you know it, the years have gone by. Don’t procrastinate but rather take the time to do it now before it’s too late.

- They Refuse To Think About It

For many Jamaicans, retirement savings is the last thing on their minds. The thought of growing old is not appealing, likewise discussing financial matters in this regard. Many will say, “I'll think about it when I get some time”, but really never do. While many Jamaicans are cognizant of the fact that this is something important to do, just to think about it seems to put a lot of pressure on the brain and so, it just gets pushed to the side or swept under the carpet until it comes to memory again. - They Think It Is Way Too Early To Start Saving Or Planning

It’s so unfortunate that many people including Jamaicans feel that there is no need to start planning for retirement until they are near retirement. This notion is so far from the truth. As a matter of fact, the sooner you start planning, the better the chance is for you to have the kind of retirement you would want in the future. It’s really never too soon to start! - They Think It Might Be Too Late

Now here’s the bombshell. Many Jamaicans may think that it’s too late for them to start their retirement savings or make a retirement plan but it’s not! However, even if you are near retirement or have actually retired, there is still hope. If you are uncertain of what to do, you can always speak with a professional.

You might feel that you are between the rock and a hard place with no retirement savings but there could still be options that you wouldn’t have even considered such as selling your home and getting a smaller one since the kids may be all grown and gone. You may also now have fewer expenses and if still employed could save a whole lot more by just simply revising how you distribute your income and even expenditures.

- They Think Their Finances Are Too Messy

“My finances are a mess or I don’t see how I can save for retirement”. These are some of the many cries for some Jamaicans who find it very challenging to balance meagre salaries with ever-growing expenses and multiple debts. However, your situation will not improve by just leaving things as they are.

If you are struggling to make ends meet and overwhelmed with debt, it would be a good idea to speak with a financial advisor who will be able to look at the bigger picture. They would most certainly be able to devise strategies to get you out of the mess you are in today and set you on a clear path for the future including your retirement savings plan. - They Don’t See A Need To

It’s mind-boggling when I hear some people say they don’t need to save or think about retirement savings as they’re all set with their regular savings account. Jamaicans love to say that. But, are you sure that there will be enough savings to meet your retirement needs? How will your income distribution go? What about the effects of inflation and even taxes? There still may be better options for investing that could be worth looking into and prove more beneficial in securing a brighter future for your retirement. - There’s Not Enough Money To Get Started

This one is a poor excuse. Many Jamaicans will say they don’t have the money or enough to get started on their retirement savings but when you take a look at the thousands of dollars spent on alcohol, parties, hairdos, shoes, and clothing, you have to wonder! Some of these funds can be easily diverted to retirement savings without any serious effects on the wants of social norms. Nothing is wrong with starting small and gradually increasing. The most important thing is to start regardless of how small the amount is! - They Are Not Sure Where To Start

Well, congratulations! You are not the first and you certainly won’t be the last. As a matter of fact, if you knew everything about financial planning, you’d probably be a Financial Advisor, wouldn’t you? This is still no excuse but at least you are ready to start. Jamaicans tend to procrastinate a lot especially when it comes to financial matters but do not put off your retirement planning because you are unsure of what to do. A professional financial advisor would be more than happy to get you started. You can check with your local banks and credit unions for these services. - My Children Will Take Care Of Me

Many Jamaicans are of the notion that their children are their “pension” and when they are old or retired, their children will take care of them. This is a grave mistake made by many who are left helpless and hopeless as sometimes it just doesn’t work this way. The children have their own families and responsibilities and while they may be able to assist, they cannot fully take you on as a responsibility. In other instances, parents have had to bury their own children for one reason or another. As you can see, this is not a very good plan for your retirement. - They Can Depend On The Government

Even though, as a working Jamaican, you would have contributed to the National Insurance Scheme (NIS), this certainly will not be enough to provide you with an ideal retirement income. And even if you were not a contributor, who wants to end up in a poor relief home or worst on the streets? It’s time to start thinking of a backup plan. The Government alone will not be able to take care of you.

I also recommend you read, I Plan to Retire in Jamaica, What Should I Do?.

Regards,

DC

References:

- Jamaicans Urged to Plan for Retirement, Jamaica Information Service, https://jis.gov.jm/jamaicans-urged-plan-retirement/

- https://nastgroupfinancial.com/the-top-10-reasons-why-people-may-not-plan-for-retirement, Nastgroupfinancial.com, https://nastgroupfinancial.com/the-top-10-reasons-why-people-may-not-plan-for-retirement

Editor's Note

Share your thoughts and comments here!.

Join in and write your own page! It's easy to do. How? Simply click here to return to Have_Your_Say.

New! Get My Latest Book👇🏿

|

You asked, I've answered! You no longer need to save for months or years, to enjoy paradise! I spilled the beans! sharing my top tips on finding cozy accommodations and secret gems, only the way a native could! Click Here to pick it up on my e-store and start saving now! |

See The Best Of Jamaica - In Videos!

|

My channel reaches over 140,000 subscribers worldwide and has leveraged over 11 million views, sharing, what I call 'The Real Jamaica'. Subscribe today and join our family of viewers. |

Read More ...

New! Experience The REAL Jamaica!

Book Your Private Tour here and experience Jamaica the way we (locals) do!

P.S. Didn't find what you were looking for?

Still need help?

Click Here to try our dependable and effective Site Search tool. It works!

Or, simply click here and here, to browse my library of over 500 questions and answers! Chances are someone already asked (and got an answer to) your question.